Key Takeaways

• Heightened Interest in Mexico: Amid ongoing trade challenges and tariff issues with China, Mexico has emerged as an attractive nearshoring alternative for U.S. companies.

• China’s Strategy: Many Chinese companies are leveraging Mexico’s manufacturing facilities to assemble goods and avoid U.S. tariffs by labeling products “Made in Mexico” when they meet certain assembly requirements.

• Room To Grow: Despite improvements, Mexico trails China in production capabilities, innovation and infrastructure.

Not long ago, a supplier approached Scott Edidin with a request – figure out how to produce 5,000 gold lamé bomber jackets for a client, and quickly.

Complicating matters was that it happened to be Chinese New Year – not a great time for a rush job from China.

Edidin, co-founder of 6AM Sourcing, an exports and logistics company specializing in sourcing promo from Mexico, developed a plan. He and his team successfully sourced materials from Vietnam and had the cutting and sewing done in Mexico. The supplier received the order on time.

“Mexico,” says Edidin, “is definitely a nearshoring opportunity.”

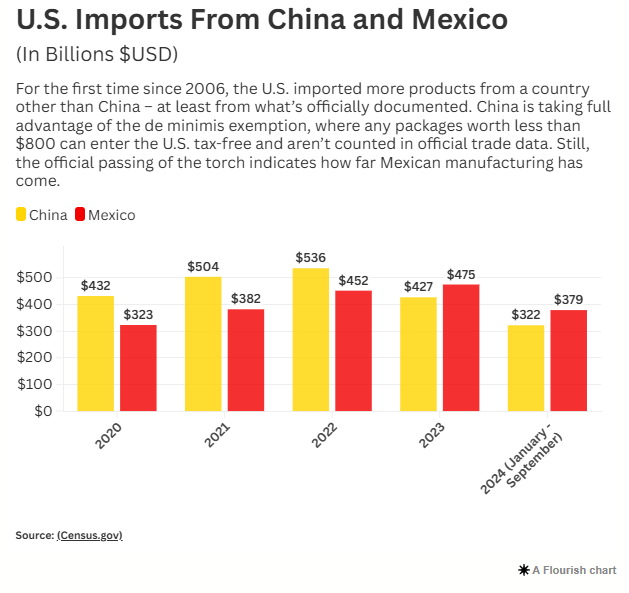

Mexico has come remarkably far as a manufacturing option – both in the promo industry and overall U.S. trade. For the first time in 20 years, the U.S. bought more from Mexico than China in 2023 ($491.3 billion to $427.2 billion).

It was in the 1960s that Mexico’s Border Industrialization Program created maquiladoras, largely duty- and tariff-free factories close to the border (which still exist today) that allowed American companies to have product assembled in Mexico and transported back to the U.S. For decades since, Mexico has been a top-three exporter to the U.S., and the passing of NAFTA and USMCA has boosted the relationship even further.

Today, products made in Mexico include cars, auto parts, electronics, appliances and medical instruments, many from Asia-based companies like Huawei, Nissan and Samsung. Promotional products too. Counselor Top 40 supplier World Emblem (asi/98264) has had a presence in Mexico for nearly 20 years, says COO Jim Kozel. They now have 800 people in Aguascalientes, including floor workers, marketing, accounting and IT, and use less-than-truckload service to move product to Miami.

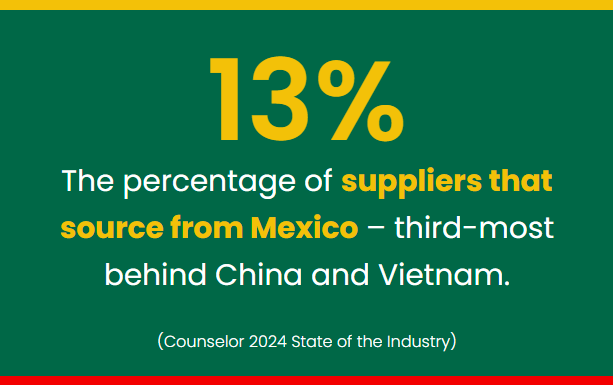

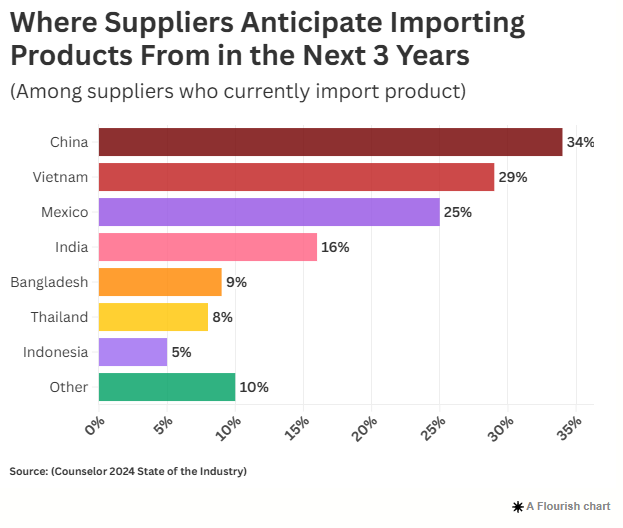

Other suppliers with locations there include Ameramark (asi/53455) in Ensenada, south of San Diego in Baja California, and Evans Manufacturing (asi/52840), part of Top 40 supplier HPG (asi/61966), which has a location in Nogales, just south of the border from Nogales, AZ. According to Counselor State of the Industry research, 13% of suppliers already source from Mexico, and a quarter anticipate increasing their importing from the U.S.’s southern neighbor over the next three years.

However, that number pales compared to the nearly 90% of suppliers who import from China. It’s a relationship the promo industry is prepared to strengthen; a third of suppliers anticipate in the next three years they’ll increase their imports from China – more than any other country.

But distributors and suppliers only have to look back a couple years to the pandemic – from China’s strict zero-COVID policies to obscene shipping costs and delays – to remember the havoc wreaked on the global supply chain. Even with COVID in the rearview mirror, trade choke points and port strikes continue to cause shipping headaches. Tariffs implemented under Donald Trump’s administration and maintained (and even increased with some products) by President Joe Biden are poised to be expanded even further by Trump after winning the presidential election. Trump has threatened to implement 60% tariffs on all Chinese imports.

Those events left promo companies questioning the extent of their relationship with China. And while most have determined it doesn’t make sense to leave China completely, they’ve also realized that relying exclusively on the country is foolhardy.

“Many companies have a ‘China Plus One’ strategy,” says Jing Rong, vice president of supply chain and sustainability at HPG. “It means they’re looking to other countries for manufacturing. But these other places don’t have enough people for these companies to leave China totally.”

Promo companies have tapped other Asian countries such as Vietnam and India. But among the potential alternatives, the idea of a country bordering the U.S. with a solid workforce and robust manufacturing is quite an appealing notion. Add in the fact that Mexico’s nearby proximity shrinks lead times and keeps down costs, and the case for the country is easy to make. It’s so compelling, in fact, that Chinese companies in other industries are flooding money into Mexico to build up manufacturing and circumvent the tariffs being levied against the Far East giant.

Does that make Mexico the nearshoring savior and the next great manufacturing hub? As promo companies are finding out, the potential is there, but the road is long and the challenges are real.

China’s Growing Presence in Mexico

When the data was released showing that Mexican imports into the U.S. surpassed China in 2023, Brad W. Setser of the Council on Foreign Relations pointed to the North American auto manufacturing’s recovery after COVID and overseas chip shortages. (A bevy of domestic and foreign automakers manufacture cars in Mexico, among them Toyota, GM and Volkswagen.)

There’s also another issue in play. Tariffs have compelled Chinese companies to move final assembly to other countries, and China sees Mexico as a place to base operations for easy access to the U.S. market and to circumvent the levies (though Trump has said recently he’ll consider 25% tariffs on Mexican-made imports in retaliation for the unfettered flow of people and drugs into the U.S. in recent years).

Data from Xeneta, an ocean freight intelligence firm, indicates that Chinese containers arriving at Mexican ports increased 60% year over year in the first quarter of 2024. More than 115,000 TEUs (a measurement of shipping containers) from China arrived in Mexico in January 2024, compared with 73,000 in January 2023. China also continues to invest in port infrastructure in Mexico, and the Mexican Association of Industrial Parks says all sites due to be built by 2027 have already been purchased.

Chinese companies like Man Wah Furniture and Hisun ATVs are exporting raw materials and components to Mexico and then manufacturing and assembling those finished products south of the border.

“While the Chinese origin of the capital coming into Mexico may be uncomfortable for the policies of some countries,” Juan Carlos Baker Pineda, Mexico’s former vice-minister for external trade, told the BBC, “according to international trade legislation, those products are, to all intents and purposes, Mexican.”

When it comes to promo however, the prospects of funneling Chinese products through Mexico are limited. When Chinese companies ship raw materials and components to Mexico, it’s often for big-ticket items like cars and appliances. With promotional products, China mostly exports finished products, says Rong. They might be imprinted in Mexico as a nearshoring option, but imprinting isn’t considered a “transformation” that’s necessary to avoid U.S. tariffs.

“Legally, companies can’t move a finished product exported from China over the U.S.-Mexico border with a ‘Made in Mexico’ sticker,” she says. “It has to be ‘Made in China’ unless there’s a significant transformation.”

With tariffs not going anywhere, not to mention cost increases due to trade choke points overseas, Mexico makes sense for China, which is laser-focused on becoming more and more competitive as a world power. And China’s investment in Mexico is helping make the latter a more attractive sourcing option as the country builds up its capabilities.

“In the U.S., we think short-term,” says Dilip Bhavnani, chief operating officer at Top 40 supplier Sunscope (asi/90075). “We have a new president every four years. The Chinese think long-term, and their big rival is the U.S.” Investment into Mexico falls in line with the Chinese plan, and they’ll work out of the country, says Bhavnani, “to save on freight and remove duties and tariffs with ‘Made in Mexico’ stickers on their finished products.”

On a recent flight from China, Edidin sat next to an executive from a power tool company owned by an Asian holding firm. The executive had just come from a production floor in Asia and was headed to a final assembly facility in Mexico.

“During COVID, they had no inventory because of the issues with the Chinese supply chain,” says Edidin, a promo veteran who teamed up with fellow promo pro Scott Pearson to found 6AM Sourcing in 2018. “Investment in Mexico is a way to deal with future disruption.”

Another reason China is moving operations to Mexico: lack of domestic labor, says Jose Gomez, president/CEO of Top 40 supplier Edwards Garment (asi/51752) and a member of the Counselor Power 50 list. China has found a ready and able workforce in Mexico.

“Chinese factories have never seen anything like this,” says Gomez. “They’re used to seeing lines of workers [in China]. They’re now considering incentives like 90-day bonuses. But the people are becoming more entrepreneurial – they want different types of jobs, and they realize they can make money with more independence.”

To be clear, foreign investment in Mexico hasn’t completely exploded like the country would want. Bloomberg Economics data shows that new investment peaked in 2022 at $18.1 billion and has since fallen to $3 billion this year. Much of the investment in Mexico over the past few years has come from companies already operating there, not new arrivals. Firms like Foxconn (a Taiwanese chip maker) and EV manufacturers Tesla and BYD are biding their time due to political uncertainty on both sides of the border. Meanwhile, new Mexican President Claudia Sheinbaum has promised to address concerns and make the country favorable for investment.

East vs. West

With China’s ongoing investment in Mexico, and as the manufacturing expertise there evolves, could the latter eventually become a wholesale replacement for China as a country of origin for promo?

Even as interest in Mexico grows, the truth is that the country is nowhere near China in terms of its production capabilities for promo. Factories there have long made large items like cars and appliances – they don’t have the expertise to innovate in many small items that the promo industry requires, says Rong.

“Mexico won’t produce 1,000 pieces of something and then switch over to something else,” she says. “They don’t design product; they just make what they’re told to make. Plus, Mexico’s minimum wage went up this year – there are lower-cost countries in Southeast Asia that are better options for our industry.”

About 6% to 8% of the apparel from Edwards Garment is made in Mexico, says Gomez. “It’s a sourcing solution, but it takes commitment and long-term development of vendors to make sure they can offer the expertise and quality,” he adds. “You can’t leave them hanging for six months. Our uniform programs help them have steadier production.”

Kozel calls Mexico a “control and command” environment when it comes to manufacturing. “They need to be told what to do,” he says. “We had to establish SOPs and processes for every department. Our goal is for them to be innovators. We want them to be very consistent with the products and to trust the process.”

Chinese factories are also incredibly fast when it comes to manufacturing. In the first hour of a work shift, says Bhavnani, they’ll finish 100 units. By the end of an eight- or 10-hour shift, they’re still making 95 units an hour. “The Chinese are capable of amazing focus,” he says. “They also have some of the best working conditions, especially when they work with big companies. Disney will do audits and check the mattress thickness in the dorms.”

Factory management and culture in Mexico are very different from China, says Edidin. In Mexico, they focus on price and quality, not as much on on-time delivery, which is critical for promo.

“We’ve had to adjust our commitments to allow for it,” adds Pearson. “We have to be onsite more. They’re on their own time and that’s a cultural difference. We respect it, but we also have customer expectations. So we set the stage differently and tell them, ‘here’s what you need to know.’”

Also adding to the cost – raw materials. Many of the components needed for promo have to be brought into Mexico. “China makes stainless steel, silicone, lithium, plastics – all with fewer environmental restrictions,” says Edidin. “In Mexico, you can get cotton, some poly, wood and some paper products. That’s about it. So most raw materials for promo have to be imported.”

Yet another challenge is violent crime. Murders in cartel-controlled areas are common; recently, a mayor was found beheaded six days after taking office in Chilpancingo and a priest outspoken against the cartels was shot and killed in Chiapas. Cargo trucks are also hijacked as they near the U.S. border by organized, opportunistic gangs, taking advantage of increased investment in Mexico. Coca-Cola, Danone, Amazon, Philip Morris and Walmart have all had merchandise stolen by hijackers, and supply chain risk analysts say about 50 trucks a day are targeted as they near the border.

But China isn’t crime-free, says Kozel – they knock off products all the time. Plus, there’s documented forced labor in Xinjiang, and of course the totalitarian Chinese Communist Party wields tremendous influence. Clearly, while different sourcing destinations have various advantages, many are fraught with significant, troubling issues that bear serious consideration.

Where Mexico Fits

As a hub for manufacturing promotional products, Mexico has room to grow. Still, despite ongoing challenges and cultural differences, Mexico’s proximity makes it an attractive country to import from, and promo is no exception. Gomez points to two types of promo products that frequently come from Mexico: blank seasonal replenishments for quick inventory boosts of popular products, as well as basic branded items with screen printing, embroidery and heat transfers.

“Companies are either setting up whole facilities with local workers, or they’re warehousing inventory and doing for-hire imprinting,” says Gomez. “Mexico has been big in cars and appliances, and now they’re looking to compete in promo.”

Bhavnani expects more promo to come out of Mexico over time, even though the lead times, infrastructure and fast production that China offers can’t be beat.

“As the pricing gets more competitive, companies will go with Mexico,” he says. “We’re seeing more imprinting facilities shipping finished products over the border. If a supplier can get a Stanley-style mug from China for $3.25 or from Mexico for $4 but they’re saving in freight, duties and tariffs, they’ll go with Mexico.”

Gomez says there’s a chance promo production in China will plateau over time, opening the door for other countries to snag a piece of the industry pie.

“China makes 90% of promo right now,” he says. “It maxed at 40% of apparel about 10 years ago, and now that’s about 35%. Perhaps China will get to 60% to 70% of promo and the rest will be picked up by countries looking to nearshore.”

Promo companies have used other countries in the Western hemisphere (especially in Central America and the Caribbean), specifically for apparel production. But none of those can match Mexico’s infrastructure and size. “When companies are looking to nearshore, it’s not Honduras or El Salvador,” says Randy Chen, president of Impex International, a company specializing in sourcing from Asia. “Mexico has a functioning government. And with all these trade choke points, companies know they can’t count on inventory from China, so they’re moving production to Mexico. Maquiladoras help them set up shop. They can print seasonal replenishments in five to 10 business days.”

While sourcing promo products from Mexico represents an opportunity, companies need to be realistic with their expectations about how soon they can be up and running. “You can’t start producing in six months,” says Kozel. “There are a lot of hoops to jump through.”

While the potential of Mexico overtaking China as a country of origin is “decades away,” says Pearson, Edidin says the ball is in Mexico’s court.

“We continue to look for more and better solutions there,” he says. “We expect the bar to be raised and factories to improve. It’s a continued development process in Mexico, and it’s up to Mexico how they’ll handle that.”